They’re young, they’re wild, they’re free – they’re the millennials. And though we encourage them to take risks and follow their dreams, some risks aren’t worth taking – like living without health insurance. Because of the Affordable Care Act, individuals are now required by law to have health coverage. However, according to a survey conducted by Princeton Survey Research Associates International, one out of every four young adults (18-29) is uninsured, despite the fact that the vast majority may qualify for financial assistance to help pay for their health coverage. So why are some millennials still relying on luck instead of taking their health care seriously? We decided to round up some common myths and share the facts.

Myth 1: “I don’t need it.”

It may be true that youth may generally have a better ability to bounce back from illness than the rest of us. That said, accidents do happen, and a sudden injury or sickness can cost thousands of dollars. Crossing your fingers and hoping all will be ok is no way to plan for your future. Moreover, the best way to stay healthy is by preventing illness. In addition to diet and exercise, taking advantage of preventive services like screenings, vaccines and tests promote healthy living – and these services are all included with health plans that can be obtained through the Illinois health insurance Marketplace.

Myth 2: “Coverage through the Marketplace isn’t affordable.”

According to an announcement from the U.S. Department of Health and Human Services (HHS), enrollment numbers in Illinois between October and December revealed that 80 percent of Marketplace customers were eligible for financial help to help lower the cost of coverage. Individuals earning up to $46,680 a year may be eligible for a tax credit to help pay for the cost of their monthly insurance premium, deductibles and other out of pocket costs.

Myth 3: “Coverage through the Marketplace is second-rate.”

Plans purchased through the Marketplace are actually the same as those obtained from private insurance companies. In fact, these plans are provided by many of the top insurance companies in the state. In addition, all plans sold through the Marketplace include Essential Health Benefits and vital wellness services such as doctor’s visits, prescription drugs, hospitalization and health screenings.

Myth 4: “It’s difficult to sign up.”

With so many health insurance options available, signing up for coverage may seem a bit complicated. But no one has to go through the process alone. In fact, there are thousands of Brokers, Agents, Navigators and other trained professionals across the state who can help individuals sign up for coverage for free. In Illinois, residents can visit GetCoveredIllinois.gov or call 866-311-1119, and they’ll help you make an appointment with a trained specialist near you.

This week is National Youth Enrollment Week, so it’s the perfect opportunity to remind the young ones in your life that the time to get affordable, quality health coverage is now. There are only a few weeks left to sign up before the February 15th deadline.

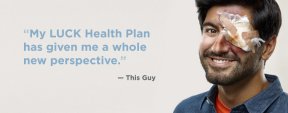

Remember almost everyone is required to have health insurance and the fines have increased this year. Residents who fail to enroll in a health insurance plan by the deadline may have to pay a penalty of either $325 per person or 2 percent of their yearly household income (whichever is higher). Relying on luck is not a health plan – Illinoisans can enroll today by visiting www.GetCoveredIllinois.gov or calling 866-311-1119.

Follow Get Covered Illinois on:

YouTube: ttps://www.youtube.com/user/CoveredIllinois

Facebook: https://www.facebook.com/CoveredIllinois

Twitter: @CoveredIllinois

Hashtag: #GetCoveredIllinois #GCISuccess