By: Gianna Gaza

Jennifer Leach, the assistant director of the Federal Trade Commission’s Division of Consumer and Business Education, often talks to individuals about their fears of credit theft and fraud. But she was once almost a victim herself.

After a surgery a few years ago, Leach received a call claiming she had overpaid on her hospital bill, and was eligible to receive compensation. It ended up being a scam, and Leach is grateful that she was able to recognize it as such. “I almost fell for it,” she said.

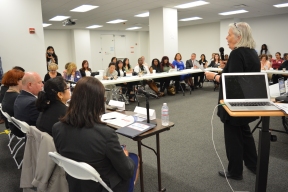

She joined about other government officials, community advocates and consumers at a recent Chicago briefing to discuss which communities are at risk for fraud and how people can prevent being victimized.

Scammers trick consumers into giving out information by preying on individual’s vulnerabilities, Leach said. “They’re professionals, and they’re good at what they do. Their job is getting your money.” For example, college students and minority communities are frequently targeted by scammers.

“Sometimes students get scammed by companies offering to reduce student debt or eliminate it all together,” said Cecilia Abundis, an Illinois Assistant Attorney General. Abundis also warns students to be wary of scholarship scams. “You don’t have to pay to obtain information about scholarships,” she said.

Minority communities also have to be more aware of scam threats.

“Black and Hispanic consumers are more likely to be victims of scams than the rest of the general population,” said panel member Steven Baker, the director of the Federal Trade Commission’s Midwest region. “There’s a correlation between low income and minority communities, making them more likely to buy into credit card scams,” he said.

Latino consumers are often victims of persons, who promise to resolve their immigration problems or who overcharge for filing immigration-related papers with the government, officials said.

Jennifer Beardsley, the staff attorney for the Chicago-based Legal Assistance Foundation, agreed. “It has to do with income and education,” she said. “It puts minority communities at higher risk for scams.”

A historic distrust between minority and immigrant communities and law enforcement also makes individuals less likely to seek assistance when they’ve become victims of fraud, Beardsley said.

“We want them to know it’s safe, and we want them to contact us,” said Baker.

Unfortunately however, reporting the crime isn’t always enough.

“At most police departments you’re going to be out of luck,” said Joel Vargas, the director of intelligence analysis for InterPortPolice Global Force, a global security company. “There is nothing police will be able to do.”

“Unfortunately in most cases there is no solution that is going to be had,” added Beardsley. Luckily though, there are precautions that can be taken to lower the chances of becoming a victim of fraud.

“Get your credit report once a year,” said Leach. “It’s the best way to see if you’ve been the victim of credit theft.”

Beardsley also advises against rushing decisions when making financial deals. “If it sounds too good to be true it is,” she said. “Never sign documents you don’t understand. If a deal is going to be gone in an instant, it probably never existed in the first place.”

The event was part of a nation-wide tour sponsored by the Federal Trade Commission, as well as New America Media, a nonprofit organization of ethnic media outlets, and the Community Media Workshop, a nonprofit group that promotes community journalism.