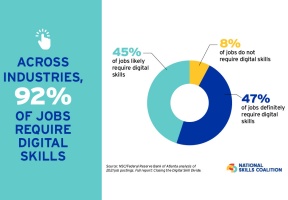

On Wednesday, the National Skills Coalition (NSC) in partnership with the Federal Reserve Bank of Atlanta released Closing the Digital Skill Divide, a real-time snapshot of demand for digital skills in the US labor market. The analysis finds that 92 percent of jobs analyzed require digital skills. Previous NSC research found one-third of workers don’t have the foundational digital skills necessary to enter and thrive in today’s jobs. Together, these findings point to a significant digital skill divide. The findings suggest that states that target resources toward digital skill building could generate measurable monetary benefits:

• Workers that qualify for jobs that require even one digital skill can earn an average of 23 percent more than in a job requiring no digital skills. Moving from a job requiring no digital skills to one requiring at least three can increase pay by an average of 45 percent.

• For the economy as a whole, these increased earnings could generate more state and federal tax revenue. Depending on the household size and composition, this could range from $1,363 to $2,879 in additional tax revenue per household per year.

• For businesses, turnover costs (estimated at $25,000 when a worker quits within the first year to over $78,000 after five years) can be averted or delayed by ensuring that workers have upskilling opportunities.

Over the next year, National Skills Coalition will work with policymakers, its member state coalitions, and corporate partner Comcast NBCUniversal to ensure more local and national leaders are aware of and take advantage of public sector digital equity funds to invest in the skill development programs that are critical to closing the digital divide. While the report focused on national data, it found that demand for digital skills is high in every state and analyzed extensive data for two states – North Carolina and Illinois – as examples. The data analysis for the report was carried out as a joint project between NSC and the Center for Workforce and Economic Opportunity at the Federal Reserve Bank of Atlanta.