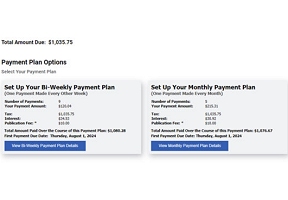

Cook County property owners have a free financial planning tool that can help them pay off their past-due property tax bills and avoid the “merciless” Annual Tax Sale, Treasurer Maria Pappas said Monday. A Payment Plan Calculator at cookcountytreasurer.com is available at no cost to help property owners who are late paying their taxes. The calculator assists taxpayers who want to budget their property tax expenses over payments made monthly or every two weeks. While the Treasurer’s Office has previously accepted partial tax bill payments, the calculator is designed to provide an actual system for those at risk of having their past-due taxes sold at the county’s Annual Tax Sale, an auction of unpaid property taxes. Many homeowners were shocked by property tax increases this year, particularly in the south and southwest suburbs. They worry what will happen if they are unable to pay their bills in full by the Thursday, Aug. 1 due date. Taxpayers may sign up to receive email or text message notifications reminding them to make the monthly or biweekly payments recommended by the Payment Plan Calculator. State law requires that property owners who do not pay their taxes in full by the due date face additional interest charges of 0.75 percent per month, effective with 2023 taxes due in 2024. Late taxes that were due in 2023 and earlier years are charged interest of 1.5 percent per month. A video tutorial is available at cookcountytreasurer.com to walk taxpayers through the steps of using the Payment Plan Calculator.